Chess and retirement planning

The decumulation game requires a dynamic strategy

- By: Doug Carroll

- January 22, 2021 January 22, 2021

- 14:00

The decumulation game requires a dynamic strategy

Planning helps reduce the negative impacts

Help your client avoid these pitfalls

Issues and strategies for Canadians thinking about transferring their U.S.-based retirement plans

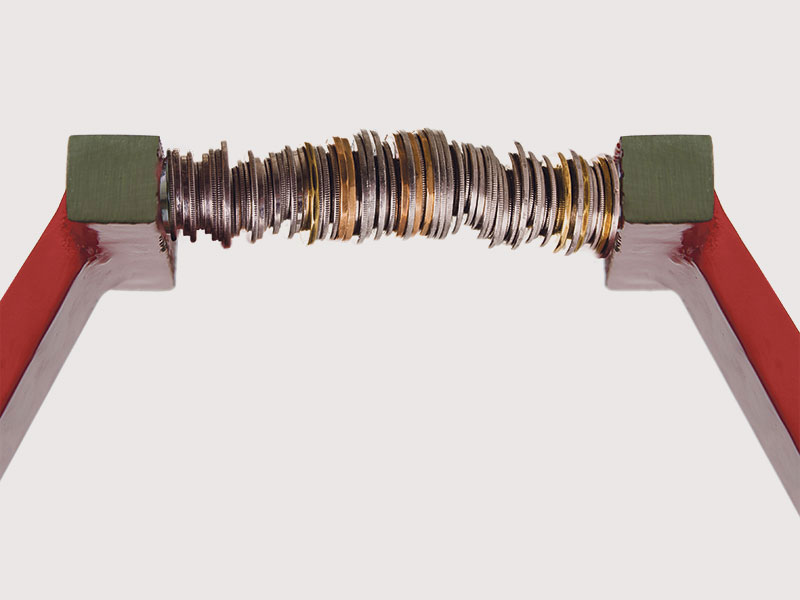

Trustees must balance the interests of income and capital beneficiaries amid economic uncertainty

Help your client avoid these estate planning pitfalls

The province is considering whether to make virtual document signing permanent and whether marriage should still revoke a will

A judge found that a father’s RRIF belonged to the estate rather than son named on plan

Find out if your client is still eligible for the PRE

The pandemic provides an opportunity for client discussion

In most cases the additional costs — and headaches — aren’t worth it

If clients need liquidity, there are options

Knowing the answer will help you and your client prepare for incapacity

Find out what the CRA says about investment income and selling a business

The idea of a “private” trust will slip from the vernacular in 2021, as the government gains new information

What is a no-contest clause, and what do executors need to know?

The Registered Disability Savings Plan requires proper planning

Find out when your client’s investment income could be subject to the tax on split income

Exercising discretion with estate assets in trusts

A recent court case illustrates the risks that come with longer lives

Be aware of the rules and considerations for a tax-deferred property transfer

Find out the criteria for determining qualified farm property

Avoid these pitfalls to access the lifetime capital gains exemption

From Tax Court drama to cross-border gifts, the most-read articles from our roster of tax experts are still relevant today

Help your client choose a vacation property with these tips